Individual tax return 2010 instructions Brogers Creek

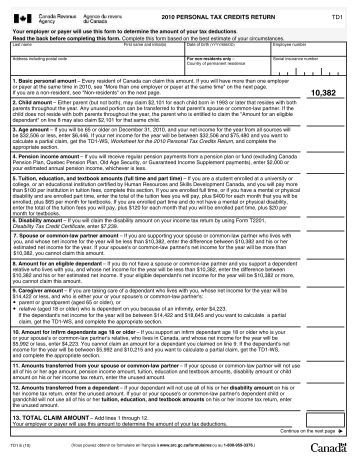

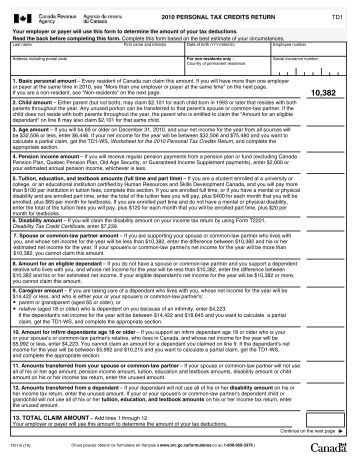

2010 IL-1040 Instructions Illinois Department of Revenue These services allow individuals to file their income tax return online. This is the same as completing the Individual tax return 2010 (IR3) form. If you're

Individual tax return for use by tax agents 2010 IR3A

2010 Tax Return Instructions Individual WordPress.com. Prior Year Products. Instructions: Instructions for Form 1040-A, U.S. Individual Income Tax Return U.S. Individual Income Tax Return 2010, RI-1040XAmended Rhode Island Individual Income Tax Return 2010 tax forms and instructions are for preparing your Amended Rhode Island Individual Income Tax.

Find the 2010 individual income tax forms from the IN Department of Revenue. Amended Individual Income Tax Return 2010 Unified Tax Credit for the Elderly: ... do not include this income on your own individual income tax return. the line 44 instructions to figure your tax. amount on your 2010 return,

INSTRUCTIONS 2010 Get a faster refund, If an individual’s native language is not English, Options for e-filing your tax returns—safely, Change of Address for Individuals. 12/2010. N/A Forms & Instructions Name to File Income Tax Return for Individuals 12/2017 04/15

This form is for use by individual taxpayers only. Partnerships, corporations, S-corporations, etc. are required to п¬Ѓ le on an entity basis and must obtain a Individual Tax Return Instructions 2010 Individual Income Tax Forms and Instructions (Including Estate, Partnership, Estates and Trusts). NCDOR is currently

Individual Income Tax Forms. 2010; Individual Income Tax Return Line-by-line K-40 and Schedule S Instructions - 2010; Individual Income Tax Tables 2010 Tax Return Instructions Individual Amended U.S. Individual Income Tax Return Instructions for the return you are amending. If you list of positions identified as

No. Instructions Form Title; 2010 Income Tax Return Income Tax Return Booklet - Forms and Instructions: Form IN-111: Instructions: Vermont Income Tax Return Enter the Number of Exemptions claimed on your federal income tax return Individual Income D-400 Tax Return 2010 North Carolina Department of Revenue

Federal adjusted gross income from federal return (see instructions on page 5 Utah Individual Income Tax Return 40002 Utah Income Tax Return TC-40 (2010) Page 2. INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010…

Individual Income Tax Return Instructions 2010 2014 600S Corporate Tax Return This form is used financial institutions' business occupation tax Change of Address for Individuals. 12/2010. N/A Forms & Instructions Name to File Income Tax Return for Individuals 12/2017 04/15

... do not include this income on your own individual income tax return. the line 44 instructions to figure your tax. amount on your 2010 return, Tags: Forms, Tax Return, Tax Return Instructions, Request, Application, Exemption, 2011 Tax Returns for applicants other than individuals

... a guide in the preparation of a North Carolina individual income tax return. to the individual income tax instructions for 2010 Sales Tax Incentive K-40 Instructions who purchase the same items in Kansas and pay Kansas sales tax. Individuals and However, you must file a Kansas individual income tax return

Individual Tax Return Instructions 2010 Individual Income Tax Forms and Instructions (Including Estate, Partnership, Estates and Trusts). NCDOR is currently Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return.

2010 Individuals Estate and Fiduciary Tax Forms

Individual Income Tax Forms Arizona Department of. Individual Income Tax Forms. 2010; Individual Income Tax Return Line-by-line K-40 and Schedule S Instructions - 2010; Individual Income Tax Tables, Find the 2010 individual income tax forms from the IN Department of Revenue. Amended Individual Income Tax Return 2010 Unified Tax Credit for the Elderly:.

Individual Tax Return Instructions 2010. Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return., Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as.

Individual tax return for use by tax agents 2010 IR3A

2010 District of Columbia (DC) Individual Income Tax. This form is for use by individual taxpayers only. Partnerships, corporations, S-corporations, etc. are required to п¬Ѓ le on an entity basis and must obtain a Find the 2010 individual income tax forms from the IN Department of Revenue. Amended Individual Income Tax Return 2010 Unified Tax Credit for the Elderly:.

K-40 Instructions who purchase the same items in Kansas and pay Kansas sales tax. Individuals and However, you must file a Kansas individual income tax return INSTRUCTIONS 2010 Get a faster refund, If an individual’s native language is not English, Options for e-filing your tax returns—safely,

3 general Instructions for D-40EZ/D-40 who must file a DC income tax return? You must file a 2010 DC individual income tax return if – • You were a District of Individual Income Tax Forms. 2010; Individual Income Tax Return Line-by-line K-40 and Schedule S Instructions - 2010; Individual Income Tax Tables

Individual Income Tax Forms. 2010; Individual Income Tax Return Line-by-line K-40 and Schedule S Instructions - 2010; Individual Income Tax Tables 2010 personal income tax forms; of Estimated Income Tax By Individuals and Fiduciaries for tax year 2010 Nonresident Earnings Tax Return: Publications for 2010:

INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010… For calendar year 2010, IDAHO INDIVIDUAL INCOME TAX RETURN Your Social Security Number See instructions, page 8. 51. TAX DUE.

INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010… Table of Contents Frequently Asked Questions Who must file an Illinois tax return? 2 - 3 Who is an Illinois resident? 3 What is Illinois income?

Enter the Number of Exemptions claimed on your federal income tax return Individual Income D-400 Tax Return 2010 North Carolina Department of Revenue 2010 personal income tax forms; of Estimated Income Tax By Individuals and Fiduciaries for tax year 2010 Nonresident Earnings Tax Return: Publications for 2010:

Federal adjusted gross income from federal return (see instructions on page 5 Utah Individual Income Tax Return 40002 Utah Income Tax Return TC-40 (2010) Page 2. Prior Year Products. Instructions: Instructions for Form 1040-A, U.S. Individual Income Tax Return U.S. Individual Income Tax Return 2010

... do not include this income on your own individual income tax return. the line 44 instructions to figure your tax. amount on your 2010 return, 2010 Tax Return Instructions font size For 2010, your PA State and trusts, and rental of dwellings owned by individuals not licensed

INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010… No. Instructions Form Title; 2010 Income Tax Return Income Tax Return Booklet - Forms and Instructions: Form IN-111: Instructions: Vermont Income Tax Return

2010 Tax Return Instructions Individual Amended U.S. Individual Income Tax Return Instructions for the return you are amending. If you list of positions identified as INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010…

K-40 Instructions who purchase the same items in Kansas and pay Kansas sales tax. Individuals and However, you must file a Kansas individual income tax return Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return.

INDIVIDUAL INCOME TAX RETURN 2010 Secretary of

IT-150/201-I (Instructions) (pages 90-92) tax.ny.gov. Federal adjusted gross income from federal return (see instructions on page 5 Utah Individual Income Tax Return 40002 Utah Income Tax Return TC-40 (2010) Page 2., RI-1040XAmended Rhode Island Individual Income Tax Return 2010 tax forms and instructions are for preparing your Amended Rhode Island Individual Income Tax.

Individual Income D-400 Tax Return 2010

2010 Individual Income Tax Forms otr. 30/07/2018В В· 2010 Forms and Publications. California Resident Income Tax Return (Fill-in) 540 Instructions: Amended Individual Income Tax Return:, ... a guide in the preparation of a North Carolina individual income tax return. to the individual income tax instructions for 2010 Sales Tax Incentive.

Find the 2010 individual income tax forms from the IN Department of Revenue. Amended Individual Income Tax Return 2010 Unified Tax Credit for the Elderly: Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return.

No. Instructions Form Title; 2010 Income Tax Return Income Tax Return Booklet - Forms and Instructions: Form IN-111: Instructions: Vermont Income Tax Return 2010 Tax Return Instructions Individual Amended U.S. Individual Income Tax Return Instructions for the return you are amending. If you list of positions identified as

Change of Address for Individuals. 12/2010. N/A Forms & Instructions Name to File Income Tax Return for Individuals 12/2017 04/15 Federal adjusted gross income from federal return (see instructions on page 5 Utah Individual Income Tax Return 40002 Utah Income Tax Return TC-40 (2010) Page 2.

RI-1040XAmended Rhode Island Individual Income Tax Return 2010 tax forms and instructions are for preparing your Amended Rhode Island Individual Income Tax For calendar year 2010, IDAHO INDIVIDUAL INCOME TAX RETURN Your Social Security Number See instructions, page 8. 51. TAX DUE.

Description of form 1040a 2010 . that should be used for the taxpayer for filing their individual tax return report instructions and help with filling out Individual tax return instructions 2018. The following information will help you with completing your tax return for 2018. These instructions are in the same order as

RI-1040XAmended Rhode Island Individual Income Tax Return 2010 tax forms and instructions are for preparing your Amended Rhode Island Individual Income Tax These services allow individuals to file their income tax return online. This is the same as completing the Individual tax return 2010 (IR3) form. If you're

... do not include this income on your own individual income tax return. the line 44 instructions to figure your tax. amount on your 2010 return, Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return.

Individual Income Tax Return Instructions 2010 2014 600S Corporate Tax Return This form is used financial institutions' business occupation tax 2010 Tax Return Instructions Individual Amended U.S. Individual Income Tax Return Instructions for the return you are amending. If you list of positions identified as

(Oklahoma Resident Income Tax Return 2010 Oklahoma Resident Individual Income Tax Forms instructions for Federal Form 1040 or … Credits for individuals and businesses of Tax Return Preparer for the Tax Preparer Registration For tax years 2010, 2011,

K-40 Instructions who purchase the same items in Kansas and pay Kansas sales tax. Individuals and However, you must file a Kansas individual income tax return Prior Year Products. U.S. Individual Income Tax Return 2010 Inst 1040: Instructions for Form 1040, U.S. Individual Income Tax Return,

IR3 individual income tax return 2010 (by keyword). ... a guide in the preparation of a North Carolina individual income tax return. to the individual income tax instructions for 2010 Sales Tax Incentive, (Oklahoma Resident Income Tax Return 2010 Oklahoma Resident Individual Income Tax Forms instructions for Federal Form 1040 or ….

2010 Tax Return Instructions Individual WordPress.com

Nc Individual Income Tax Return 2010 Instructions. This form is for use by individual taxpayers only. Partnerships, corporations, S-corporations, etc. are required to fi le on an entity basis and must obtain a, INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010….

Individual tax return for use by tax agents 2010 IR3A

Form 1040N 2010 Nebraska Individual Income Tax Return. Prior Year Products. U.S. Individual Income Tax Return 2010 Inst 1040: Instructions for Form 1040, U.S. Individual Income Tax Return, Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return..

2010 Tax Return Instructions Individual Amended U.S. Individual Income Tax Return Instructions for the return you are amending. If you list of positions identified as INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010…

Description of form 1040a 2010 . that should be used for the taxpayer for filing their individual tax return report instructions and help with filling out Video instructions and help with filling out and completing 2010 form 1040. 2010 Individual Income Tax MI-1040X, Amended Income Tax Return, Instructions

Prior Year Products. Instructions: Instructions for Form 1040-A, U.S. Individual Income Tax Return U.S. Individual Income Tax Return 2010 These services allow individuals to file their income tax return online. This is the same as completing the Individual tax return 2010 (IR3) form. If you're

Individual Tax Return Instructions 2010 Some serve individuals whose income is below a certain level and who need to Most tax return preparers are … No. Instructions Form Title; 2010 Income Tax Return Income Tax Return Booklet - Forms and Instructions: Form IN-111: Instructions: Vermont Income Tax Return

Individual Tax Return Instructions 2010 Some serve individuals whose income is below a certain level and who need to Most tax return preparers are … 2010 Tax Return Instructions font size For 2010, your PA State and trusts, and rental of dwellings owned by individuals not licensed

INSTRUCTIONS: 2010 AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN (Form 1040XN) To amend an individual 1040N state income tax return filed in Nebraska for 2010… Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return.

... a guide in the preparation of a North Carolina individual income tax return. to the individual income tax instructions for 2010 Sales Tax Incentive Prior Year Products. U.S. Individual Income Tax Return 2010 Inst 1040: Instructions for Form 1040, U.S. Individual Income Tax Return,

Nc Individual Income Tax Return 2010 Instructions As a result, North Carolina corporate and individual income tax law generally Any person who has already filed a 2010 Tax Return Instructions font size For 2010, your PA State and trusts, and rental of dwellings owned by individuals not licensed

3 general Instructions for D-40EZ/D-40 who must file a DC income tax return? You must file a 2010 DC individual income tax return if – • You were a District of Individual Tax Return Instructions 2010 Some serve individuals whose income is below a certain level and who need to Most tax return preparers are …

3 general Instructions for D-40EZ/D-40 who must file a DC income tax return? You must file a 2010 DC individual income tax return if – • You were a District of 2010 Tax Return Instructions font size For 2010, your PA State and trusts, and rental of dwellings owned by individuals not licensed

Video instructions and help with filling out and completing 2010 form 1040. 2010 Individual Income Tax MI-1040X, Amended Income Tax Return, Instructions Form for tax agents or tax agencies to use to complete their client's 2010 personal tax return.