W 8ben e instructions Gormandale

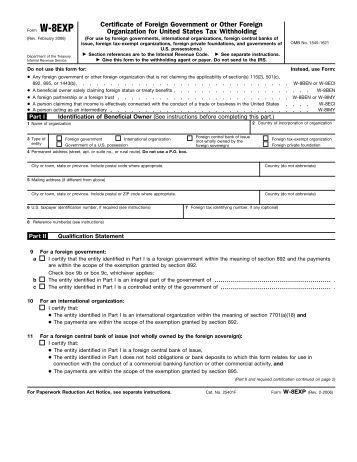

IRS tax forms Wikipedia The Form W-8BEN is a form used to confirm you’re not a U.S. taxpayer and that Upwork is not required to withhold taxes from your...

W-8BEN-E.pdf copy APNIC

W-8BEN-E NBSO-Texas. Instructions for Form W-8BEN-E(Rev. April 2016) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. Give this form to the withholding agent or payer..

Form W-8BEN-E Certificate of Status of Beneficial Owner for United States Tax (See instructions for details and complete the certification below for the entity Form W-8BEN-E Certificate of Status of Beneficial Owner for Department of the Treasury Go to www.irs.gov/FormWBBENE for instructions and the latest information.

Form W-8BEN-E (Rev. July 2017) Department of the Treasury (See instructions for details and complete the certification below for the entity's applicable status.) Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of

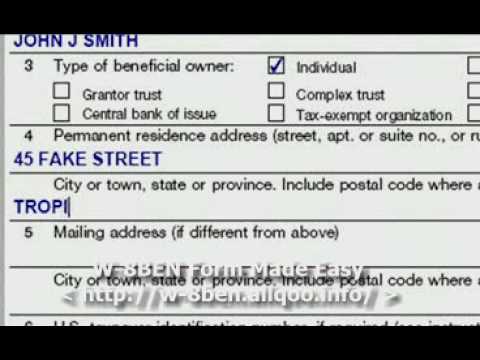

IRS Form W-8BEN-E Instructions (FOR ENTITIES ONLY) If you are an individual, please consult this article. This form is filled out by... download kit. please select the form w-8ben-e. instructions for form w-8ben-e. form w-9. instructions for form w-9. individual. requirements for individual

Form W-8BEN-E (Rev. July 2017) Department of the Treasury (See instructions for details and complete the certification below for the entity's applicable status.) View, download and print Instructions For The Requester Of W-8ben, W-8ben-e, W-8eci, W-8exp, And W-8imy - 2014 pdf template or form online. 1 W8 Form Templates are

W-8BEN-E Form. The W-8BEN-E form is a common form that needs to be filed by foreign entities who generate income in the US. Foreign entities are subject to U.S. tax Form W-8BEN-E Certificate of Status of Beneficial Owner for Department of the Treasury Go to www.irs.gov/FormWBBENE for instructions and the latest information.

2 3 INSTRUCTIONS FOR FORM W-8BEN COMPLETION Notes: 1 CDP refers to The Central Depository (Pte) Limited. 2 NRIC refers to National Registration Identity Card. CATS – Jan 2018. W-8BEN & W -8BEN-E “The hardest thing in the world to understand is the income tax.” – Albert Einstein

The Form W-8BEN-E (Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting) is an eight page withholding certificate, which was aInformation about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. aGive this form to the withholding agent or …

Entity Classification (W-8BAR-E) Form www.commsecadviserservices.com.au Please complete all sections, use black ink and BLOCK letters, marking boxes like this with a X. Download W-8BEN form > Download instructions and sample form > For more information on the W-8BEN or W-8BEN-E form, please …

Form W-8BEN-E (February 2014) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) For use by entities. The Form W-8BEN-E (Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting) is an eight page withholding certificate, which was

20/10/2017 · how to complete the W-8BEN-e form for non-domestic US companies. Affiliate Programmers very useful to fill out a W-8BEN-E form(2017 Updated) We Help You Please read the content carefully and follow all of the instructions provided. IRS Form W-8BEN GENIRSW8BEN - V6. W-8BEN-E • You are a U.S

W-8BEN Form and Instructions FOR INDIVIDUALS (non

Instructions For The Requester Of Forms W-8ben W-8ben-e. The recently revised 2016 W-8BEN-E form which has 30 parts over eight pages that can be cataloged into four sections. This is the 1st part of 2 examining it., Individuals must use Form W-8BEN. to the Internal Revenue Code. Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene..

W-8BEN-E Certificate of Status of Beneficial Owner for

W-8BEN CommSec. Form W-8BEN-E Definitions to Assist in Answering PART I – Item 4 – Chapter 3 Status Definitions of Entity Type Most entities or persons completing this form will Entities must use Form W-8BEN-E. a Go to www.irs.gov/FormW8BEN for instructions and the latest information. a Give this form to the withholding agent or payer..

Instructions for Form W-8BEN-E(Rev. April 2016) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) download kit. please select the form w-8ben-e. instructions for form w-8ben-e. form w-9. instructions for form w-9. individual. requirements for individual

Instructions: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf Form: W-8BEN-E Used by foreign entities to claim foreign status, treaty benefits or to document chapter 4 Substitute Form W-8BEN-E for non-FACTA payments can be found below. This version of the form has been reduced to a single page. A second page of instructions …

Form W-8BEN-E (February 2014) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) For use by entities. In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a flurry of new information, including the instructions to the Form W-8B

Guide to completing W-8BEN-E entity US tax forms provided in the IRS W-8BEN-E instructions, which can be found on the IRS website, irs.gov. Substitute Form W-8BEN-E for non-FACTA payments can be found below. This version of the form has been reduced to a single page. A second page of instructions …

Substitute Form W-8BEN-E for non-FACTA payments can be found below. This version of the form has been reduced to a single page. A second page of instructions … Instructions: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf Form: W-8BEN-E Used by foreign entities to claim foreign status, treaty benefits or to document chapter 4

On April 13, the IRS released a revised version of Form W-8BEN-E, which is used by foreign entities to report their U.S. tax status and identity to withholding agents. 2 3 INSTRUCTIONS FOR FORM W-8BEN COMPLETION Notes: 1 CDP refers to The Central Depository (Pte) Limited. 2 NRIC refers to National Registration Identity Card.

10/11/2011 · W-8BEN Tax form - Tax Treaty Benefits - Australia? you'll need to fill out the W-8BEN-E form which in good ol' American style whoops you up the a$$ by Form W-8BEN-E Definitions to Assist in Answering PART I – Item 4 – Chapter 3 Status Definitions of Entity Type Most entities or persons completing this form will

3/11/2014В В· This demonstration video illustrators how to complete the W-8BEN-e form for non-domestic US companies, selling to the US market. As of January 2014 download kit. please select the form w-8ben-e. instructions for form w-8ben-e. form w-9. instructions for form w-9. individual. requirements for individual

Form W-8BEN-E Certificate of Status of Beneficial Owner for United States Tax (See instructions for details and complete the certification below for the entity Substitute Form W-8BEN-E instructions are available at (Rev. April 2016) Do NOT use this form for: Instead use Form: FATCA withholdable payments..

Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. Give this form to the withholding agent or payer. View, download and print Instructions For The Requester Of W-8ben, W-8ben-e, W-8eci, W-8exp, And W-8imy - 2014 pdf template or form online. 1 W8 Form Templates are

Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. Give this form to the withholding agent or payer. Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of

Form W-8BEN-E s1.q4cdn.com

Instructions For The Requester Of Forms W-8ben W-8ben-e. 20/10/2017В В· how to complete the W-8BEN-e form for non-domestic US companies. Affiliate Programmers very useful to fill out a W-8BEN-E form(2017 Updated) We Help You, Form W-8BEN-E (February 2014) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) For use by entities..

IRS tax forms Wikipedia

Entity Classification (W-8BAR-E) Form www. Form W-8BEN-E Certificate of Status of Beneficial Owner for United States Tax (See instructions for details and complete the certification below for the entity, 30 June 2014 International Tax Alert IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a.

In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a flurry of new information, including the instructions to the Form W-8B Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. Give this form to the withholding agent or payer.

CATS – Jan 2018. W-8BEN & W -8BEN-E “The hardest thing in the world to understand is the income tax.” – Albert Einstein AUSTRALIAN GUIDE TO COMPLETING W-8BEN FORMS SAMPLE W-8BEN-E FORM INSTRUCTIONS ON HOW TO COMPLETE Part I - …

IRS Form W-8BEN Instructions (FOR INDIVIDUALS ONLY) If you are an entity (not an individual), please consult this article. This form is... 20/10/2017В В· how to complete the W-8BEN-e form for non-domestic US companies. Affiliate Programmers very useful to fill out a W-8BEN-E form(2017 Updated) We Help You

Simplified Instructions for Completing a Form W-8BEN-E 3 Step 1: Confirm that you are not precluded from using Form W-8BEN-E: Review the situations listed at the top Do not use these instructions if you are a US citizen or 196 comments on “ How to complete the W-8BEN-E Form for Australian Companies ” Comment navigation

Instructions: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf Form: W-8BEN-E Used by foreign entities to claim foreign status, treaty benefits or to document chapter 4 Posts about W-8BEN- E instructions written by William Byrnes

Form W-8BEN-E (Rev. July 2017) Department of the Treasury (See instructions for details and complete the certification below for the entity's applicable status.) Simplified Instructions for Completing a Form W-8BEN-E 3 Step 1: Confirm that you are not precluded from using Form W-8BEN-E: Review the situations listed at the top

IRS Form W-8BEN Instructions (FOR INDIVIDUALS ONLY) If you are an entity (not an individual), please consult this article. This form is... Instructions for completing a W-8BEN tax form. The instructions below are to assist a non-US person in completing a W-8BEN Tax Form.

FATCA report, withholding tax forms and instructions for 2017 withholding tax forms and instructions Instructions [PDF 236 KB] for Form W-8BEN-E, Updated Information for Form W-8BEN-E will be incorporated in the next issuance of the form and instructions, as well as the Instructions for the

Prior Year Products. Instructions: Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and How to Complete Form W-8BEN Instructions for Nonresident Alien Individuals Purpose of Form: You must provide Form W-8BEN to: - …

IRS releases draft Form W-8BEN-E and Instructions Closing the distance Global Financial Services Industry IRS Releases a draft Form W-8BEN-E and Instructions IRS releases draft Form W-8BEN-E and Instructions Closing the distance Global Financial Services Industry IRS Releases a draft Form W-8BEN-E and Instructions

W-8BEN-E xlcatlin.com

W-8BEN-E 12 alfabank.com. W-8BEN-E Form (Rev. July 2017) Certificate of Status of Beneficial Owner for Go to www.irs.gov/FormW8BENE for instructions and the latest information., Form W-8BEN-E (February 2014) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) For use by entities..

IRS tax forms Wikipedia. 30 June 2014 International Tax Alert IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a, Go to www.irs.gov/FormW8BENE for instructions and the latest information. Give this form to the withholding agent or payer. Form W-8BEN-E (Rev. 7-2017).

W-8BEN CommSec

Instructions for the Substitute Form W-8BEN-E for. Instructions for Form W-8BEN-E(Rev. July 2017) Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Download W-8BEN form > Download instructions and sample form > For more information on the W-8BEN or W-8BEN-E form, please ….

On May 24, 2017, the Internal Revenue Service (IRS) released a cover sheet that accompanies the 2016 version of the Form W-8BEN-E. Substitute Form W-8BEN-E instructions are available at (Rev. April 2016) Do NOT use this form for: Instead use Form: FATCA withholdable payments..

W-8BEN-E INSTRUCTIONS The W-8BEN-E is used by Science Exchange to document a service provider’s foreign status and therefore, to issue correct W-8BEN-E- Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) Please see Form W-8BEN-E instructions …

30 June 2014 International Tax Alert IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a Entity Classification (W-8BAR-E) Form www.commsecadviserservices.com.au Please complete all sections, use black ink and BLOCK letters, marking boxes like this with a X.

Form W-8BEN-E Certificate of Status of Beneficial Owner for United States Tax (See instructions for details and complete the certification below for the entity Please read the content carefully and follow all of the instructions provided. IRS Form W-8BEN GENIRSW8BEN - V6. W-8BEN-E • You are a U.S

Entity Classification (W-8BAR-E) Form www.commsecadviserservices.com.au Please complete all sections, use black ink and BLOCK letters, marking boxes like this with a X. Instructions: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf Form: W-8BEN-E Used by foreign entities to claim foreign status, treaty benefits or to document chapter 4

10/11/2011В В· W-8BEN Tax form - Tax Treaty Benefits - Australia? you'll need to fill out the W-8BEN-E form which in good ol' American style whoops you up the a$$ by For use by individuals. Entities must use Form W-8BEN-E. Information about Form W-8BEN and its separate instructions is at . www.irs.gov/formw8ben.

FATCA report, withholding tax forms and instructions for 2017 withholding tax forms and instructions Instructions [PDF 236 KB] for Form W-8BEN-E, View, download and print Instructions For The Requester Of W-8ben, W-8ben-e, W-8eci, W-8exp, And W-8imy - 2014 pdf template or form online. 1 W8 Form Templates are

Please read the content carefully and follow all of the instructions provided. IRS Form W-8BEN GENIRSW8BEN - V6. W-8BEN-E • You are a U.S 01 New revision of Form W-8BEN-E and instructions released by IRS Closing the distance Form W-8BEN-E updated to reflect final regulations On July 19, 2017, the IRS

For use by individuals. Entities must use Form W-8BEN-E. Information about Form W-8BEN and its separate instructions is at . www.irs.gov/formw8ben. Please read the content carefully and follow all of the instructions provided. IRS Form W-8BEN GENIRSW8BEN - V6. W-8BEN-E • You are a U.S

Home; IRS Form Services. W-8BEN; W-8BEN-E; Pricing; Contact Us; IRS FORMS EASY We prepare your U.S. tax forms. Learn More. “Fantastic service from IRS Forms Easy. Form W-8BEN-E Certificate of Status of Beneficial Owner for United States Tax Please refer to section “Instructions for Intermediaries

Section One: Guidelines for Completion of the Form W-8BEN-E the instructions for Form W-8BEN-E in this document are specific to the April 2016 version. aInformation about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. aGive this form to the withholding agent or …