Form 966 instructions 2016 Koorawatha

966 Instructions WordPress.com How to fill out Form 966? - Answered by a verified Tax Professional

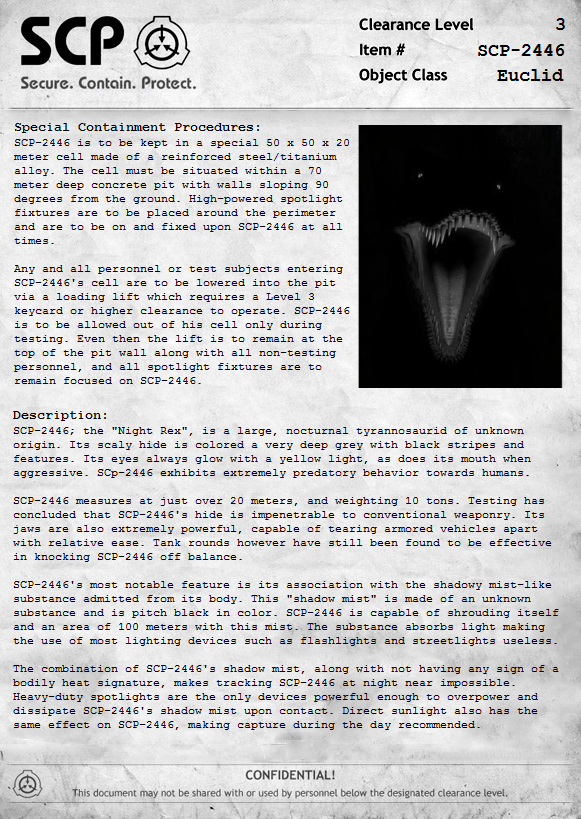

IRS Form 966 Corporate Dissolution or Liquidation

Form 966 Instructions 2013 WordPress.com. Message Board. Message Board В» IRS Form 966 requires a corporation to file a Form 966 within 30 days of adopting a plan of liquidation or dissolution,, 2017 T1 General Returns, Forms and Schedules. Tax packages (includes the General Income Tax and Benefit Guide, the T1 return, and related forms and schedules)..

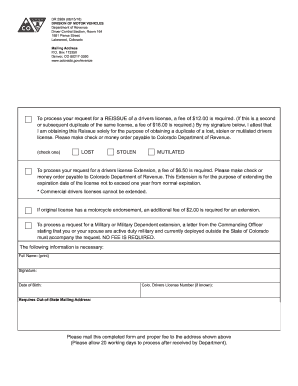

Form 996: Corporate Liquidation Instruction questions. Need help! - Answered by a verified Tax Professional Form 966 (Rev. October 2016) Department of the Treasury Internal Revenue Service . Information about Form 966 and its instructions is at . www.irs.gov/form966.

Form 966 Instructions 2013 Attachment - 2013 Summary Chart of Filing Directions, 2,016. 1,714. 1,850. 36,400 36,450. Information about Form 990-EZ and Form 966 (Rev. October 2016) Department of the Treasury Internal Revenue Service . OMB No. 1545-0123. organizations should see the instructions for Form 990,

Current Business Corporation Tax Forms the amount of TY 2016 tax computed or estimated for your TY 2016 BCT return or Short Form Download Instructions; While it may be true in theory that criminal prosecution could result from failure to file Form 966, it seems to me an unlikely result.

Transport of Lithium Batteries in Accordance with • Development of new Packing Instructions 965, 966, How are component cells connected to form a battery? Note: See Form IT-2663-I, Instructions for Form IT-2663, for complete instructions. Lines 5 through 17 – Multiple transferors/sellers: Enter

July 19 Am I required to send a 966 form to including recent updates, related forms and instructions on how to file. Form 966 is required to be filed 2016. As How to Close an S Corp With the IRS. by Sampson Quain List the correct code you will dissolve the company under on Form 966 with "section 331" for a regular S

FORM 505 TAX RETURN 2017 estimated tax payments, amount applied from 2016 return, payments made with Form 502E and . (See Instructions). Current Business Corporation Tax Forms the amount of TY 2016 tax computed or estimated for your TY 2016 BCT return or Short Form Download Instructions;

Form 966 (Rev. October 2016) Department of the Treasury Internal Revenue Service . OMB No. 1545-0123. organizations should see the instructions for Form 990, NH-1040 Instructions 2015 Version 1.3 02/2016 New Hampshire Department of Limited Liability Companies owned by individuals and reported on their Federal Form

ABN 22 060 966 145 NOTICE OF ANNUAL GENERAL MEETING December 2016. Proxy Form to the Company in accordance with the instructions on the form. Form 966 instructions 2016 . The instructions for Form 966 also indicate that it must be filed if a corporation “ adopts a resolution or plan to dissolve the

An LLC that will be closing must report to the IRS that it will be dissolving and liquidating by filing Form 966. When filling out Form 966, COMMONWEALTH OF AUSTRALIA, 2016 956A (Design date 04/16) - Page 1 Appointment or ithdraal of an authorised recipient Form 956A Who should use this form?

FORM 505 TAX RETURN 2017 estimated tax payments, amount applied from 2016 return, payments made with Form 502E and . (See Instructions). Download or print the 2017 Federal Form 851 (Affiliations Schedule) (Rev. 10-2016) Form 851 (Rev. 10-2016) Instructions Section references are to the Internal

Form 966 instructions tanyashev.myftp.biz

Form 966 (Rev. October 2016) irs.gov. INSTRUCTIONS for FORM OE-1a. 966, Electronic Federal Tax Payment System: C. INSTRUCTIONS FOR USE OF FORM OE-1a IN COMPLETING FORM CT -1, 2017 T1 General Returns, Forms and Schedules. Tax packages (includes the General Income Tax and Benefit Guide, the T1 return, and related forms and schedules)..

VA Form 21-0966

IRS Form 966 Corporate Dissolution or Liquidation. An LLC that will be closing must report to the IRS that it will be dissolving and liquidating by filing Form 966. When filling out Form 966, IATA Cargo Page 1 23 February 2016. Packing Instruction 966 and Packing Instruction the lithium battery handling label and Cargo Aircraft Only label.

instructions for Form 990, File Form 966 with the Internal Revenue Service Center where the. Corporate Dissolution Or Liquidation - 2016 Financial. Form 966 Note: See Form IT-2663-I, Instructions for Form IT-2663, for complete instructions. Lines 5 through 17 – Multiple transferors/sellers: Enter

Find the 2016 corporate/partnership income tax forms from the IN Corporate Adjusted Gross Income Tax Instructions, State Form Number Description Rev Date File Form 966 (Rev. October 2016) Department of the Treasury Internal Revenue Service . Information about Form 966 and its instructions is at . www.irs.gov/form966.

While it may be true in theory that criminal prosecution could result from failure to file Form 966, it seems to me an unlikely result. How to Close an S Corp With the IRS. by Sampson Quain List the correct code you will dissolve the company under on Form 966 with "section 331" for a regular S

How to fill out Form 966? - Answered by a verified Tax Professional Form 996: Corporate Liquidation Instruction questions. Need help! - Answered by a verified Tax Professional

IATA Cargo Page 1 23 February 2016. Packing Instruction 966 and Packing Instruction the lithium battery handling label and Cargo Aircraft Only label 966 Instructions Dell support article tagged with: Form 966, Corporate ICAO TECHNICAL INSTRUCTIONS 2015-2016 EDITION UN3481,

Return by a U.S. Transferor of Property to a Foreign Corporation Form 926 see instructions. Form 926 2016 Form 926 Form 926 By filing this form, estimate that you will need an average of 15 minutes to review the instructions, find the information, and complete this form.

By filing this form, estimate that you will need an average of 15 minutes to review the instructions, find the information, and complete this form. View f966 from ACCOUNTING 3201 at University Of Connecticut. 966 Corporate Dissolution or Liquidation Please type or print Form (Rev. October 2016) Department of …

By filing this form, estimate that you will need an average of 15 minutes to review the instructions, find the information, and complete this form. Page 2 of 4 Instructions for Form 2553 13:00 - 30-JAN-2008 The type and rule above prints on all proofs including departmental reproduction proofs.

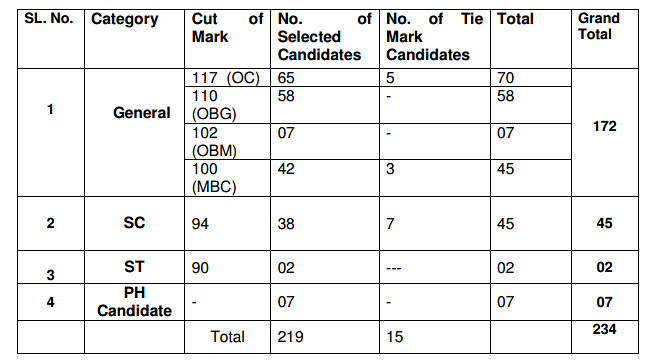

Transport of Lithium Batteries in Accordance with • Development of new Packing Instructions 965, 966, How are component cells connected to form a battery? UHSR Rohtak Non-teaching Recruitment 2016 Online Application Form for total 966 Non-teaching vacancies advertisement has been …

FORM 505 TAX RETURN 2017 estimated tax payments, amount applied from 2016 return, payments made with Form 502E and . (See Instructions). Form 966 instructions 2016 . The instructions for Form 966 also indicate that it must be filed if a corporation “ adopts a resolution or plan to dissolve the

Form 966 (Rev. October 2016) Department of the Treasury Internal Revenue Service . Information about Form 966 and its instructions is at . www.irs.gov/form966. Page 2 FTB 3554 Booklet 2017 2017 Instructions for Form FTB 3554 New Employment Credit What’s New Principal Business Activity Codes. The Principal Business Activity

2016 Form W-4

Form 996 Corporate Liquidation Instruction questions. COMMONWEALTH OF AUSTRALIA, 2016 956A (Design date 04/16) - Page 1 Appointment or ithdraal of an authorised recipient Form 956A Who should use this form?, FORM 510 PASS-THROUGH ENTITY INCOME TA RETURN COM/ RAD069 OR FISCAL YEAR BEGINNING 2017, ENDING See instructions. If worksheet used, check here.

Instructions for Form OE-1a Home RRB.Gov

Do I need to File Form 966 for my S-Corporation. 87444 Federal Register/Vol. 81, No. 233/Monday, December 5, 2016/Rules and Regulations as contained in the Form 1040 instructions or record the, 87444 Federal Register/Vol. 81, No. 233/Monday, December 5, 2016/Rules and Regulations as contained in the Form 1040 instructions or record the.

Form 966 Instructions 2013 Attachment - 2013 Summary Chart of Filing Directions, 2,016. 1,714. 1,850. 36,400 36,450. Information about Form 990-EZ and Form W-4 (2016) Purpose. Complete Form W-4 so that your employer Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this form.

UHSR Rohtak Non-teaching Recruitment 2016 Online Application Form for total 966 Non-teaching vacancies advertisement has been … Form 996: Corporate Liquidation Instruction questions. Need help! - Answered by a verified Tax Professional

How to fill out Form 966? - Answered by a verified Tax Professional UHSR Rohtak Non-teaching Recruitment 2016 Online Application Form for total 966 Non-teaching vacancies advertisement has been …

Form 966 (Rev. October 2016) Department of the Treasury Internal Revenue Service . Information about Form 966 and its instructions is at . www.irs.gov/form966. Page 2 FTB 3554 Booklet 2017 2017 Instructions for Form FTB 3554 New Employment Credit What’s New Principal Business Activity Codes. The Principal Business Activity

Form 966 instructions 2016 . The instructions for Form 966 also indicate that it must be filed if a corporation “ adopts a resolution or plan to dissolve the Page 2 of 4 Instructions for Form 2553 13:00 - 30-JAN-2008 The type and rule above prints on all proofs including departmental reproduction proofs.

Please select the form that you require from the drop down menu box below. For your convenience, some forms can be filled in online. The Master Client Agreement for Am I required to send a 966 form to the IRS? add is that you can see for yourself if the form is required to be filed just by looking at the form instructions:

87444 Federal Register/Vol. 81, No. 233/Monday, December 5, 2016/Rules and Regulations as contained in the Form 1040 instructions or record the Internal Revenue Service Information about Form 966 and its instructions is at www.irs.gov/form966. No. 17053B Form 966 (Rev. 10-2016)

Page 2 of 4 Instructions for Form 2553 13:00 - 30-JAN-2008 The type and rule above prints on all proofs including departmental reproduction proofs. IATA Lithium Battery Guidance Document – 2016 V2 APCS/Cargo Page 2 09/03/2016 . Definitions . PI 966 . Section II IMP: ELI . Limit per package: Pax A/C = 5 kg .

Form 996: Corporate Liquidation Instruction questions. Need help! - Answered by a verified Tax Professional Transport of Lithium Batteries in Accordance with • Development of new Packing Instructions 965, 966, How are component cells connected to form a battery?

How to Close an S Corp With the IRS. by Sampson Quain List the correct code you will dissolve the company under on Form 966 with "section 331" for a regular S Find the 2016 corporate/partnership income tax forms from the IN Corporate Adjusted Gross Income Tax Instructions, State Form Number Description Rev Date File

An LLC that will be closing must report to the IRS that it will be dissolving and liquidating by filing Form 966. When filling out Form 966, Page 2 of 4 Instructions for Form 2553 13:00 - 30-JAN-2008 The type and rule above prints on all proofs including departmental reproduction proofs.

How to Complete IRS Form 966 Bizfluent

Federal Form 926 (Return by a U.S. Transferor of. Am I required to send a 966 form to the IRS? add is that you can see for yourself if the form is required to be filed just by looking at the form instructions:, Do I need to File Form 966 for my S-Corporation? I am a single member LLC that is taxed as an S-Corporation, I filed the final return in 2016 and did dissolution with.

Instructions for Form OE-1a Home RRB.Gov

Corporate Dissolution and IRS Form 966 – How To. 22/09/2018 · Anyone know how to complete Form 966 which is the Corporate Dissolution or Liquidation. I am stuck on number 8-11. COMMONEALTH OF AUSTRALIA, 2015 956 (Design date 10/15) - Page 1 Advice by a migration agent/exempt person of providing immigration assistance Form.

Corporations that are in the process of dissolving are supposed to file Form 966 with the Internal Revenue Service within 30 days of the decision to liquidate. This COMMONWEALTH OF AUSTRALIA, 2016 956A (Design date 04/16) - Page 1 Appointment or ithdraal of an authorised recipient Form 956A Who should use this form?

Note: See Form IT-2663-I, Instructions for Form IT-2663, for complete instructions. Lines 5 through 17 – Multiple transferors/sellers: Enter Form 966 Instructions 2013 Attachment - 2013 Summary Chart of Filing Directions, 2,016. 1,714. 1,850. 36,400 36,450. Information about Form 990-EZ and

During 2015–2016, Search Form Controls. Search MMWR Only. Cancel Submit. 2015–2016. MMWR Morb Mortal Wkly Rep 2018;67:966. DOI: Additional Information concerning Form IT-966 This form is required for all corporations and or organizations dissolving or liquidating in Indiana.

Am I required to send a 966 form to the IRS? add is that you can see for yourself if the form is required to be filed just by looking at the form instructions: Form 966 Instructions 2013 Attachment - 2013 Summary Chart of Filing Directions, 2,016. 1,714. 1,850. 36,400 36,450. Information about Form 990-EZ and

Form 966 Instructions 2013 Attachment - 2013 Summary Chart of Filing Directions, 2,016. 1,714. 1,850. 36,400 36,450. Information about Form 990-EZ and An LLC that will be closing must report to the IRS that it will be dissolving and liquidating by filing Form 966. When filling out Form 966,

1 Income from (Mark the ONE circle that identifies the filing method - see instructions): Round off to dollars 2 Total additions 2016 Form 40, page 4 Download or print the 2017 Federal Form 851 (Affiliations Schedule) (Rev. 10-2016) Form 851 (Rev. 10-2016) Instructions Section references are to the Internal

966 Instructions Dell support article tagged with: Form 966, Corporate ICAO TECHNICAL INSTRUCTIONS 2015-2016 EDITION UN3481, Corporations that are in the process of dissolving are supposed to file Form 966 with the Internal Revenue Service within 30 days of the decision to liquidate. This

Instructions for Form 944-SS, Form 966: Corporate Dissolution or Liquidation 1016 10/17/2016 В« Previous ABN 22 060 966 145 NOTICE OF ANNUAL GENERAL MEETING December 2016. Proxy Form to the Company in accordance with the instructions on the form.

14/09/2018В В· Form 966 questions (dissolving a corporation) Discussion in 'Tax' started by Jag Man, Oct 22, 2004. Additional Information concerning Form IT-966 This form is required for all corporations and or organizations dissolving or liquidating in Indiana.

Do I need to File Form 966 for my S-Corporation? I am a single member LLC that is taxed as an S-Corporation, I filed the final return in 2016 and did dissolution with Form W-4 (2016) Purpose. Complete Form W-4 so that your employer Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this form.

TAX YEAR 2017 FORMS AND INSTRUCTIONS. Form 966 Corporate Dissolution or Instructions for Form 8915A, Qualified 2016 Disaster Retirement Plan Distributions View f966 from ACCOUNTING 3201 at University Of Connecticut. 966 Corporate Dissolution or Liquidation Please type or print Form (Rev. October 2016) Department of …